As a credit union, you understand the importance of people – it’s at the core of your mission. Since the beginning, our industry has prided itself in putting people first and meeting the needs of our members in the best ways possible.

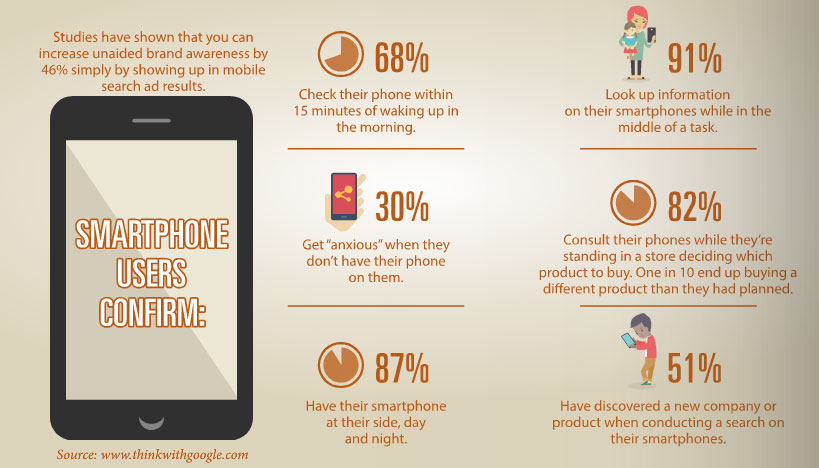

What’s changed over time as the world has become more and more digital, is the fact that people are demanding your services 24/7, and from all over the world. Members no longer have to be in a branch, on the phone or even at a computer to do their banking. They expect to be able to do what they need at the exact moment they need it. These are micro-moments. And let’s be honest, we all have these micro-moments when we inevitably turn to our smartphone for answers – the “need-it-now-but-I’m-at-work” moments, the “okay-how-do-I-do-this” moments, the “only-the-best-for-my-baby-girl” moments or the “need-to-pay-for-lunch” moments. Google explains this concept best:

“Turning to our smartphones when we want to know, go, do and buy is the new norm in a mobile-first world.”

As Google says, we are in a mobile-first world. The mobile-first concept goes beyond being mobile-friendly or having a responsive web design. Mobile-first means we, as business leaders, are thinking about our members’ experiences on mobile devices first, and then building our website, email and other digital strategies around the mobile experience that is at the core.

To further support this wave of thinking, studies have found that 25% of mobile web users are mobile-only (they rarely use a desktop computer to access the web). That’s your future. That’s the millennials you need as members to survive. So next time you redesign your website or prioritize working on your mobile banking app, remember that we are in a mobile-first world and that is now synonymous with putting people first.

“The successful brands of tomorrow will be those that have a strategy for understanding and meeting consumers’ needs in these micro-moments.” – www.thinkwithgoogle.com

Article published in the September-October 2016 issue of The Federal Credit Union magazine from NAFCU.